- Individual Life Plans

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

- Child Education And marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

- Group Life & Pension

- Insurance for Gulf

- Health Insurance

- Bancassurance

- Takaful

- Introduction

- Individual Takaful

- Product Information

- Current Funds Price

- Historical Fund Price

- Banca Takaful

- Products

- Partner Banks

- Group Life Takaful

- Group Health Takaful

- FAQs

- Real Estate

Individual Life Plans

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

- Child Education And marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban Plan

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

Contact

- Head Office

- Network of Individual Life Insurance Offices

- Network of Group & Pension business

- Life Insurance Business (Gulf)

- Find an Agent

Real Estate

English

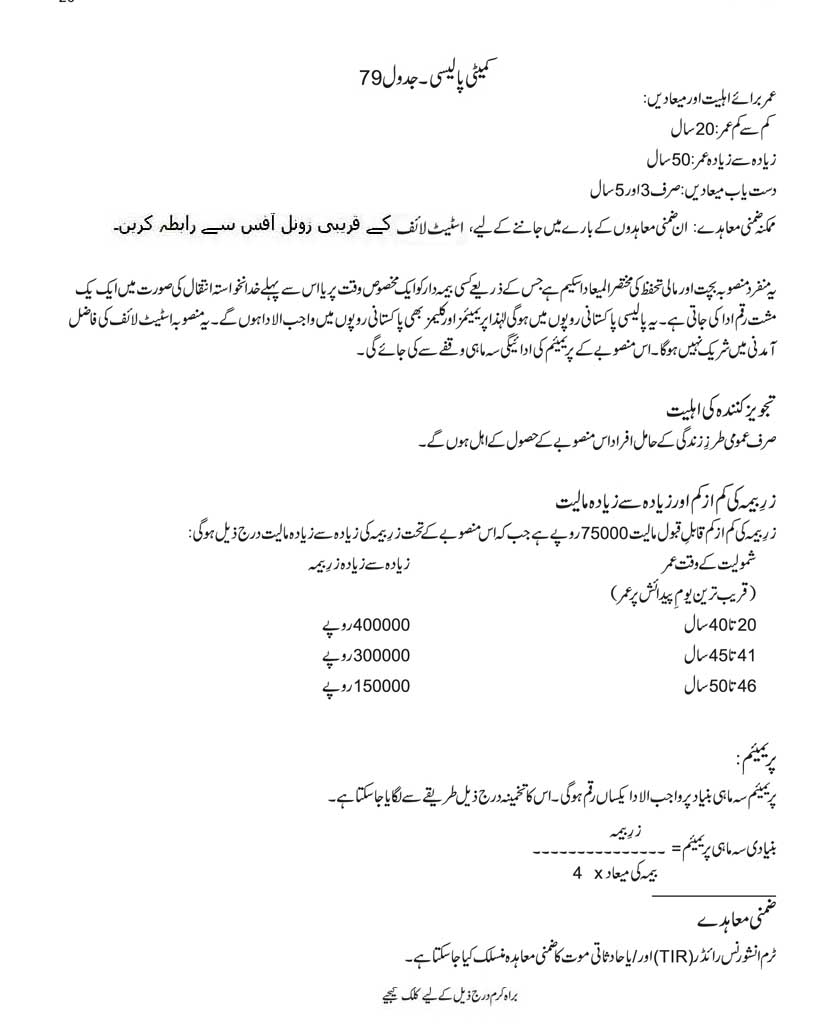

Committee Policy

Eligible ages and Terms:-

Minimum Age : 20 years

Maximum Age : 50 years

Terms Available: 3 and 5 years only.

This plan is a unique short term savings and protection scheme through which the policyholder can get a lump sum amount of money at a specified time or on death (God Forbid), if earlier. The policy would be a Pak Rupees policy and hence all premiums and claims would be payable in Pak Rupees. This plan would not participate in the Actuarial Surplus of State Life. The premium paying mode of this plan would be quarterly.

ELIGIBLE PROPOSER:

Only Standard Lives shall be eligible to own the plan.

MINIMUM AND MAXIMUM SUM ASSURED:

The minimum acceptable Sum Assured would be Rs. 75,000. The maximum Sum Assured under the plan will be as follows:

| Age at entry (Age nearest birthday) |

Maximum Sum Assured Rs. |

| 20 to 40 years | 400,000 |

| 41 to 45 years | 300,000 |

| 46 to 50 years | 150,000 |

PREMIUM:

Premium is a level amount payable quarterly. It will be calculated as follows:

Basic Quarterly Premium = Sum Assured

Term of Assurance x 4

SUPPLEMENTARY CONTRACTS:

Term Insurance Rider (TIR) and/or Accidental Death Benefit (ADB) can be attached.